Bill English to outline broad parameters of agreement to National Party caucus and board; Says a lot of progress made in last 24 hours, but that there's still time for more negotiations

By Alex Tarrant

There has been a lot of progress in negotiations between National and New Zealand First over the past 24 hours, National Party leader Bill English has said on his way to update the party’s caucus on the broad parameters of the current agreement with New Zealand First.

English is set to then hold a teleconference going over the same details with the National Party board. He said he would seek support from both entities to go ahead with being able to form a government with New Zealand First if that’s what the 'Kingmaker' party decides.

He wasn’t giving much else away Thursday morning, although did say there is still time for negotiations to continue if required. Any tweaks from now would likely not be material enough to require going back to the caucus and board again, he said.

NZ First leader Winston Peters is set to announce a decision on government formation sometime this afternoon – his caucus is spending the morning in final discussions while also checking in with their party’s board for last-minute sign-offs.

It’s not known yet whether Peters will privately tell English and Labour leader Jacinda Ardern about his decision before he makes his public announcement – he’s reportedly said that he’ll consider whether to do so or not. He didn't in 1996.

Labour is set to discuss its agreed policy platform with its governing council this morning as well. National and Labour were both stressing Wednesday evening that they had no indication which way NZ First would go – something English repeated again Thursday morning. National “look forward” to hearing what Peters’ decision will be, he said.

The discussions that have been held indicate National will be able to work with New Zealand First, English said. “We’ve had a period of intensive negotiation and I’m satisfied that the agreement we’ve reached with New Zealand First would be able to form the basis of a strong and cohesive government.”

Asked whether there’s still room for renegotiation on some points of the agreement, English said: “I suppose there’s always that potential up until the announcement is made. There’s been a lot of progress in the last 24 hours.”

“Futher discussion can be had,” English said. “The deadline is the announcement.” But he was confident enough to be in a position now where he could present to the caucus and the National Party board an outline of the agreement.

In response to a question, English said he hadn’t considered whether he’d resign if Peters went with Labour.

Sunny day in Wellington; Farmers might be happy

MPs were filing into the Parliamentary precinct Thursday morning – many National Party members spotted by Interest.co.nz wearing black and white outfits, although after several days of ‘stakeout’, anything passes as a hint. Asked whether there had been an advisory put out to do so, National’s education spokesperson Nikki Kaye replied with a firm “no comment.”

The general response to the question of ‘how are you feeling about today’ related to the weather – it is, admittedly, a beautiful day in Wellington.

One little snippet from an NZ First MP during the morning – Invercargill-based Mark Patterson was asked on his way in whether the final deal will be good for the farming community: Either way, there’ll be some good stuff, came the response.

Source: Latest stories from interest.co.nz | 19 Oct 2017 | 11:32 am

Despite little change in prices, Indian demand is rising again, China demand stays high, and freight rates are up. The lower NZD has improved returns especially from Australia

Log prices paid by mills were generally unchanged with the occasional price increase for unpruned logs. Prices received for export logs delivered in October dropped on average $1-$2/JASm3 from September prices for non-pruned and $3-4/JASm3 for pruned logs.

There has been a significant and relatively unforeseen increase in ocean freight rates. This increase has averaged about US$7/JASm3 and has been partially offset by the weakening of the NZD against the USD. Freight rates are expected to level out in November.

China log demand remains steady with occasional small price increases, and October is traditionally the highest price point in the second half of the year for logs in China. The Korean log market is once again steady, and the Indian log markets shows signs of recovery.

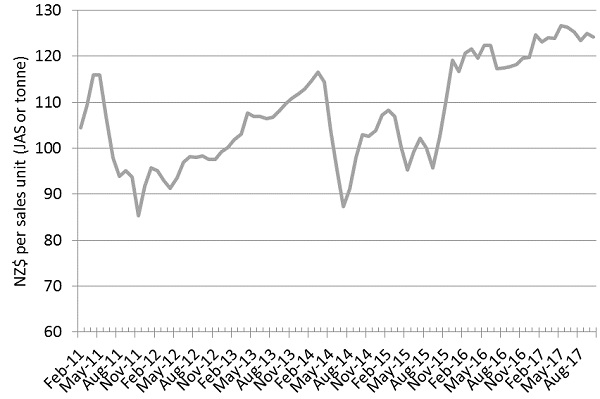

Due to the decrease in export prices the PF Olsen Log Price Index for October has reduced to $124. The average sale price is currently $10 per tonne above the three-year average.

Domestic Log Market

Demand

The domestic mills report very little change in domestic demand other than the usual variations due to weather. There have been a few slight changes in some export lumber markets, but these were well anticipated and had no effect on the local mills.

The domestic mills have also experienced an increase in the ocean freight costs, but have benefitted by the weakening NZD. Approximately 14% of NZ lumber exports (by value) are to Australia, and the weakening of the NZD by a couple of cents since mid-August has increased returns. These exporters however, do have to contend with one of the most expensive ocean freight costs across the Tasman Sea, ranging from $70-$100NZ/m3.

Log supply

Log supply continues to be balanced around most of the country. There are some regional shortages as has been reported in the media about Northland. The mills in Canterbury are also concerned about supply going forward. This has been exacerbated by the windthrow of 2013 which removed some 1.5M tonnes of standing timber and its effect on wood-flow is being noticed sooner than thought.

Export Log Market

China

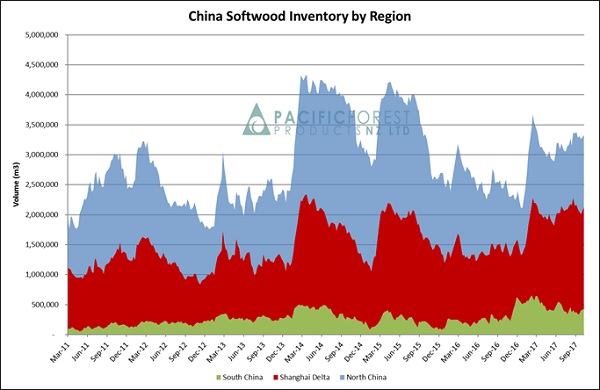

The market remains well balanced between supply and demand. The stock levels across China continue to hover around 3.3M m3, and rose only slightly during China’s “Golden Week” holiday in the first week of October. The demand is still very strong across all log grades, with a healthy daily offtake of 65K m3/day. One interesting point about the current inventory in China is that the percentage of radiata pine logs has decreased while the percentage of North American logs has increased. This is even though the supply of North American logs dropped 18% in August. This shows New Zealand logs have been more saleable than the more expensive North American logs.

Courtesy: Pacific Forest Products (PFP)

India

The Indian market has remained dull and flat for the last three months with prices hovering around US$150/JASm3 for A Grade longs, and shipping rates touching US$38 to $40/JASm3 making exports to India almost unviable. The key factor for the flat market behaviour has been liquidity issues stemming out of GST upfront payment to the Indian Tax Department at the time of releasing cargo from port.

September was a slow shipment month from NZ to India with just three vessels heading to India. This caused some relief in the Kandla market, and sawn timber prices have become marginally bullish in the first half of October as log stocks have depleted. However, there will be virtually no change in the market in October, as the festival of Diwali implies working holidays and mill closures until 30 Oct 2017. The CEO for Aubade NZ (a large exporter of New Zealand logs to India) Satinder Singh expects November/December to be the turnaround period and feels a strong sentiment emerging for demand to increase as cash cycles affected by GST filing are expected to have normalised. Aubade NZ forecast the Indian log market is set to accommodate on average 5-6 vessels per month from NZ for 2018.

This augers well for log prices and supply in the period of Nov 2017–Feb 2018. This would be very welcome news as February 16, 2018 is the Chinese New Year. The Indian market could provide a good balance to keep demand reasonable.

Korea

The Korean log market is a very mature log market with no significant changes forecast. The current geo-political climate with North Korea seems to have little effect on log demand, and any demand fluctuation is mainly market driven. Kwang Won Lumber Co Ltd which is the second largest buyer of logs in Incheon, Korea, stopped buying logs in July, and logs destined for this mill were diverted to other mills and overall demand was diminished. This mill re-commenced buying in September under court control. Due to this situation log sales to Korea in Aug 2017 were 8% down on the same month in 2016, but log sales are still 8% up on an annualised basis.

Ocean Freight

The ocean freight price to ship logs from New Zealand to China has increased by an average of $7/m3 USD across the country. While I did report last month that “industry commentators now suggest indications are for increasing freight rates in Q4”, these increases are more than expected. The two main factors driving this recent increase in freight costs are detailed below. Most market commentators expect this to be short term and not have lasting effect on ocean-freight rates:

-

There have been significant vessel delays due to monsoon and other weather events around Asia. The port of Chittagong in Bangladesh, for example, at one point had 150 ships waiting for a berth. While this port often struggles with increasing demand, that is a lot of ships! This means there is a reduction in the available shipping capacity.

-

There has been a surge in freight demand due to iron ore and coal being imported to China before new stringent environmental regulations come into effect. In last month’s Wood Matters PF Olsen indicated how the tightening environmental regulations may affect local saw millers and here we see another consequence of this for the NZ forest industry. While iron ore and coal tend to be shipped in the larger Capesize and Panamax vessels, the demand cascades down the dry bulk carrier fleet. Material that was shipped in Panamax carriers starts getting shipped in Supramax and Handymax vessels, and so on. The Wood Matters edition of March this year has an explanation of the freight scene for further reference.

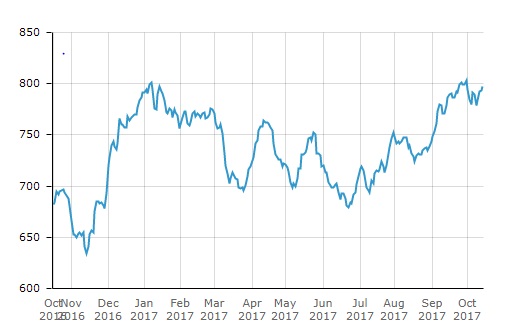

The Bunker World Index (BWI)

The price for fuel bunker has trended upwards since mid-June of this year.

BWI graph courtesy of S&P Global Platts.

Foreign Exchange

The exchange rate continues to have a significant impact on AWG prices for logs. The NZD relative to the USD has continued to drop from the high of 0.7503 in July to 0.7179 in mid- October. This reduction in the NZD has countered the effect of rising freight costs on the ‘At Wharf Gate’ prices received for logs in New Zealand.

PF Olsen Log Price Index to October 2017

The PF Olsen Log Price Index for October decreased one dollar from the September index figure and is now at $124.The index is currently $3 higher than the two-year average, $10 above the three-year average and $14 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – October 2017

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Oct-17 | Sep-17 | Aug-17 | Jul-17 | Jun-17 | Oct-17 | Sep-17 | Aug-17 | Jul-17 | Jun-17 | |

| Pruned (P40) | 182 | 182 | 183 | 183 | 188 | 179 | 179 | 175 | 175 | 180 |

| Structural (S30) | 120 | 120 | 120 | 118 | 112 | |||||

| Structural (S20) | 109 | 108 | 108 | 107 | 104 | |||||

| Export A | 137 | 138 | 134 | 139 | 141 | |||||

| Export K | 131 | 132 | 127 | 131 | 133 | |||||

| Export KI | 122 | 123 | 119 | 122 | 125 | |||||

| Pulp | 47 | 47 | 47 | 47 | 50 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

This article is reproduced from PF Olsen's Wood Matters, with permission.

Source: Latest stories from interest.co.nz | 19 Oct 2017 | 11:23 am

Statistics New Zealand says housing costs increased 50.5% in the past decade, while household income rose just 42%

By David Hargreaves

If you've thought in the past 10 years that your housing costs have been rising faster than your income - then you are probably right.

Statistics New Zealand's new household income and housing costs figures for the year to June show that in the past 10 years housing cost rises did indeed outstrip increases in household income.

In fact in that period household income rose 42% while annual housing costs increased by some 50.5%. Both increases have been more than twice the rate of inflation over the same period.

Since 2007, average annual household income is up nearly $30,000 to reach $98,621 (before tax) in 2017.

But over the same 10 years, average annual housing costs increased from $10,658 to $16,037. Inflation, as measured by the consumers price index, increased 20.2%.

But the news is slightly better when looked at over just the past year - which of course has seen house price increases moderate.

In the year ended June 2017, average weekly housing costs were $318.50, almost unchanged from 2016. Lower mortgage interest rates helped to largely dampen any increases in housing costs.

Average mortgage interest payments were significantly lower for the June 2017 year (down 11.6% to $250.80 a week), falling from $283.70 a week for the year ended June 2016.

Of course, more recently, mortgage interest rates have started to edge up again as the banks respond to funding pressures through declining rates of deposit uptake.

Stats NZ said renters were almost three times as likely as home owners to spend 40% or more of their household income on housing costs.

For the June 2017 year, about one in five (20.8%) renting households spent 40% or more of their household income on rent and other housing costs.

In contrast, fewer than one in 10 (7.8%) of people who owned, or partly owned, their own home spent 40% or more of their household income on housing costs.

Key facts

In the 10 years to June 2017:

► average annual household income (from all regular sources) increased 42%, to reach $98,621 for the year ended June 2017

► average weekly housing costs increased 52%, to reach $318.50 for the year ended June 2017.

For the year ended June 2017:

► average annual personal income was $51,945, up 7.7% from 2016

► average annual personal income for females increased at a much higher rate (9.2%) than for males (6.7%), when compared with 2016

► for every $100 of household income, New Zealand households spent an average of $16.40 on housing costs

► about 1 in 8 (12.5%) households spent 40% or more of their total household income on housing costs

► 65% of respondents reported their income was enough or more than enough to meet their everyday needs, while 10% stated they didn’t have enough to get by

► 82% of respondents said they were satisfied or very satisfied with their life in general.

Source: Latest stories from interest.co.nz | 19 Oct 2017 | 11:20 am

Rising yields suggest the residential property market could be returning to fundamentals, where income becomes more important than capital gain for investors

The residential property market could be at an important turning point for investors as rental yields start to rise.

A rental yield is a standardised way of comparing the potential gross income returns different properties could produce for investors.

It is the amount of rent a property could potentially generate in a year expressed as a percentage of its purchase price.

A higher yield suggests a property would provide a better rental return for an investor than one with a lower yield.

Until recently, yields have been trending lower as property prices rose faster than rents, reducing the rental returns available to investors.

But that appears to be changing, according to interest.co.nz’s Residential Investment Property Rental Yield Indicator.

The Indicator tracks the REINZ’s lower quartile selling prices for three bedroom houses in 56 locations around the country where there are high levels of rental activity, and matches them with the median rents on newly rented three bedroom houses in the same areas.

This allows it to track changes in the income earning potential of rental properties throughout the country.

The trend has been for yields to fall, as property prices have risen faster than rents, which has led to many investors chasing capital gains ahead of rental income.

But that now looks to have changed.

The latest Indicator shows that yields have risen in 27 of the locations monitored, fallen in 16 and were unchanged in 13, based on REINZ lower quartile selling prices and median rents on newly let properties in the six months to September (see table below).

That compares with 20 locations that showed rising yields, 27 that showed falls and nine that were unchanged based on prices and rents for the six months to June.

The trend was particularly pronounced in Auckland, where yields rose in six of the suburbs monitored, were unchanged in three but didn’t decline in any of them, and also in Christchurch.

But the indicative yields were also mostly rising or flat in places like the Waikato and Bay of Plenty which have been hot spots for residential property investors over the last couple of years.

That suggests a significant change in conditions for investors, and may mark a return to a market that is driven by fundamentals, where investors focus on long term income returns rather than capital gains.

In most cases the rising yields were driven by increases in rents but often also by falls in lower quartile selling prices.

However it is still early days and the indicative yields remain extremely low in most main centres.

In Auckland, they remain below 5% in all of the districts monitored and below 4% in half of them.

So the market may have some distance to travel before the returns are attractive enough to encourage a major jump in investor activity in the absence of capital gains.

The change also presents some challenges for investors who purchased rental properties several years ago.

They are likely to have seen a substantial increase in the capital value of their properties along with steadily increasing rental income.

With interest rates remaining at very low levels they would likely be in a very fortunate situation.

But if the market has turned, they will need to consider whether the money they have tied up in those investments is now working hard enough for them.

They will need to decide whether to hang on to their properties for growth in rental income and flat or possibly declining capital values, or cash up and take the the capital gains and reinvest the money elsewhere.

The outlook for interest rates is likely to be a major factor in whichever way they decide to go.

Indicative gross rental yields for three bedroom houses in 56 selected areas with high rental activity during the previous six months. Based on REINZ lower quartile selling prices and median rents recorded by Tenancy Services' Bonds Centre in each area over the previous six months. Indicative gross rental yields for three bedroom houses in 56 selected areas with high rental activity during the previous six months. Based on REINZ lower quartile selling prices and median rents recorded by Tenancy Services' Bonds Centre in each area over the previous six months. |

|||||||||||||

| Town/region | Yield % Sept 2017 | Yield % June 2017 |

Yield % March 2017 | Yield % Dec 2016 | Yield % Sept 2016 | Yield % June 2016 | Yield % March 2016 | Yield % Dec 2015 |

Yield %

Sept 2015

|

Yield %

June 2015 |

Yield %

March 2015

|

Yield %

Dec 2014

|

Sept 2014

|

| Whangarei: | |||||||||||||

| Kamo/Tikipunga/Kensington | 5.3 | 5.5 | 5.4 | 5.4 | 5.9 | 6.1 | 6.0 | 5.6 | 7.1 | 6.5 | 6.9 | 7.6 |

6.4

|

|

|

|||||||||||||

| Rodney - Orewa/Whangaparaoa | 4.0 | 4.0 | 4.0 | 3.8 | 3.9 | 4.1 | 4.1 | 4.1 | 4.3 | 4.5 | 4.5 | 4.6 |

4.8

|

|

|

|||||||||||||

| North Shore: |

|

||||||||||||

| Beach Haven/Birkdale | 4.0 | 3.8 | 3.7 | 3.7 | 3.7 | 3.7 | 3.9 | 3.8 | 3.9 | 4.0 | 4.3 | 4.3 |

4.6

|

| Torbay | 3.6 | 3.6 | 3.7 | 3.6 | 3.4 | 3.6 | 3.8 | 3.6 | 3.8 | 4.0 | 4.5 | 4.6 |

4.5

|

|

|

|||||||||||||

| Waitakere: |

|

||||||||||||

| Glen Eden | 3.9 | 3.9 | 4.0 | 3.8 | 3.7 | 3.9 | 4.0 | 4.0 | 4.1 | 4.3 | 4.6 | 4.9 |

5.1

|

| Massey/Royal Heights | 3.9 | 3.8 | 4.0 | 3.9 | 3.8 | 4.1 | 4.1 | 4.0 | 4.1 | 4.4 | 4.6 | 4.9 |

5.1

|

| Henderson | 4.1 | 4.0 | 3.9 | 3.8 | 3.8 | 3.8 | 4.1 | 4.1 | 4.1 | 4.4 | 4.7 | 4.9 |

5.0

|

|

|

|||||||||||||

| Central Auckland: |

|

||||||||||||

| Avondale | 3.6 | 3.5 | 3.6 | 3.6 | 3.7 | 3.6 | 3.7 | 3.7 | 3.9 | 4.1 | 4.2 | 4.4 |

4.5

|

|

|

|||||||||||||

| Manukau: |

|

||||||||||||

| Highland Park | 3.8 | 3.6 | 3.5 | 3.5 | 3.4 | 3.3 | 3.3 | 3.6 | 3.6 | 3.8 | 3.8 | 4.1 |

4.3

|

| Papakura/Drury/Karaka | 4.7 | 4.3 | 4.3 | 4.4 | 4.4 | 4.7 | 4.8 | 4.8 | 4.9 | 5.5 | 5.6 | 5.9 |

6.0

|

| Franklin - Pukekohe/Tuakau | 4.8 | 4.8 | 4.6 | 4.4 | 4.3 | 4.5 | 4.9 | 5.0 | 5.0 | 5.3 | 5.5 | 5.6 |

5.6

|

|

|

|||||||||||||

| Hamilton: |

|

||||||||||||

| Deanwell/Melville/Fitzroy | 4.8 | 4.8 | 4.8 | 5.0 | 5.1 | 5.4 | 5.3 | 5.5 | 6.2 | 6.8 | 6.9 | 6.9 |

6.9

|

| Fairfield/Fairview Downs | 4.5 | 4.5 | 4.9 | 4.8 | 4.8 | 5.1 | 5.4 | 5.7 | 6.0 | 6.8 | 6.7 | 6.2 |

7.0

|

| Te Kowhai/St Andrews/Queenswood | 4.6 | 4.5 | 4.4 | 4.3 | 4.6 | 4.7 | 4.7 | 4.9 | 5.3 | 5.4 | 5.4 | 5.6 |

5.8

|

|

|

|||||||||||||

| Cambridge/Leamington | 4.4 | 4.4 | 4.6 | 4.6 | 4.7 | 4.8 | 5.2 | 5.3 | 5.2 | 5.5 | 5.5 | 5.6 |

5.9

|

| Te Awamutu | 5.0 | 5.1 | 5.0 | 5.1 | 5.2 | 5.2 | 5.7 | 6.2 | 6.3 | 6.5 | 6.2 | 6.3 |

6.4

|

|

|

|||||||||||||

| Tauranga: |

|

||||||||||||

| Tauranga Central/Greerton | 5.1 | 4.7 | 4.6 | 4.4 | 4.3 | 3.7 | 5.2 | 5.2 | 5.6 | 6.0 | 6.1 | 5.9 |

5.9

|

| Bethlehem/Otumoetai | 4.1 | 4.0 | 4.1 | 3.7 | 4.2 | 4.2 | 4.6 | 4.8 | 4.8 | 4.5 | 4.8 | 5.3 |

5.4

|

| Mt Maunganui | 4.3 | 4.4 | 4.4 | 4.2 | 4.2 | 4.4 | 4.8 | 4.6 | 4.7 | 5.4 | 5.7 | 5.6 |

5.2

|

| Pyes Pa/Welcome Bay | 4.7 | 4.3 | 4.8 | 4.8 | 4.9 | 4.8 | 5.4 | 5.5 | 5.3 | 5.9 | 5.7 | 5.7 |

5.8

|

| Kaimai/Te Puke | 5.0 | 4.9 | 5.3 | 5.4 | 5.5 | 5.6 | 5.8 | 5.9 | 6.2 | 6.4 | 6.2 | 6.2 |

5.7

|

| Whakatane | 6.1 | 6.0 | 6.1 | 5.8 | 6.5 | 6.6 | 6.4 | 7.1 | 7.3 | 6.7 | 6.3 | 6.7 |

6.9

|

| Roturua: | |||||||||||||

| Holdens Bay/Owhata/Ngapuna | 9.3 | 10.5 | 8.0 | 9.7 | 10.7 | 9.4 | 8.7 | 8.3 | 8.7 | n.a. | n.a. | n.a. | n.a. |

| Kuirau/Hillcrest/Glenholm | 5.6 | 5.5 | 4.9 | 7.3 | 7.5 | 6.4 | 5.9 | 6.3 | 6.6 | n.a. | n.a. | n.a. | n.a. |

| Ngongataha/Pleasant Heights/Koutu | 8.5 | 6.2 | 8.6 | 8.2 | 7.2 | 7.9 | 7.7 | 8.0 | 8.2 | n.a. | n.a. | n.a. | n.a. |

| Hastings - Flaxmere | 9.9 | 9.3 | 8.9 | 8.6 | 9.4 | 9.3 | 10.9 | 11.5 | 11.0 | 12.1 | 12.2 | 11.7 |

11.8

|

|

|

|||||||||||||

| Napier - Taradale | 4.4 | 4.9 | 5.0 | 4.9 | 5.1 | 5.5 | 5.4 | 5.6 | 5.5 | 5.3 | 6.2 | 6.3 |

6.1

|

| Taranaki: | |||||||||||||

| New Plymouth Central/Moturoa | 5.4 | 4.9 | 4.7 | 5.3 | 5.1 | 5.4 | 5.8 | 5.4 | 5.5 | n.a. | n.a. | n.a. | n.a. |

| Waitara/Inglewood | 6.0 | 7.2 | 8.1 | 7.0 | 7.7 | 7.7 | 8.8 | 8.9 | 8.0 | n.a. | n.a. | n.a. | n.a. |

| Whanganui | 8.7 | 8.6 | 9.1 | 9.7 | 9.7 | 10.3 | 9.6 | 10.0 | 14.9 | n.a. | n.a. | n.a. | n.a. |

| Palmerston North: | |||||||||||||

| Kelvin Grove/Roslyn | 6.3 | 6.5 | 6.6 | 6.6 | 7.0 | 7.3 | 7.4 | 7.2 | 7.2 | n.a. | n.a. | n.a. | n.a. |

| Palmerston North Central | 5.5 | 6.0 | 5.9 | 5.6 | 6.5 | 6.3 | 5.6 | 5.5 | 6.2 | n.a. | n.a. | n.a. | n.a. |

| Takaro/Cloverlea/Milson | 6.2 | 6.2 | 6.1 | 6.3 | 6.7 | 6.8 | 7.2 | 7.1 | 7.3 | n.a. | n.a. | n.a. | n.a. |

|

|

|||||||||||||

| Kapiti Coast: |

|

||||||||||||

| Paraparaumu/Raumati | 5.0 | 4.9 | 4.8 | 5.3 | 5.6 | 5.7 | 5.9 | 6.0 | 6.1 | 6.2 | 6.1 | 6.1 |

5.9

|

| Waikanae/Otaki | 4.7 | 4.7 | 5.2 | 5.5 | 5.8 | 5.8 | 5.9 | 6.5 | 6.8 | 6.6 | 6.7 | 5.5 |

5.4

|

|

|

|||||||||||||

| Upper Hutt: | |||||||||||||

| Heretaunga/Silverstream | 5.4 | 4.7 | 4.7 | 4.6 | 5.3 | 5.6 | 5.8 | 5.8 | 6.1 | n.a. | n.a. | n.a. | n.a. |

| Totara Park/Maoribank/Te Marua | 5.7 | 5.8 | 5.8 | 5.2 | 5.7 | 6.2 | 6.3 | 6.2 | 6.8 | n.a. | n.a. | n.a. | n.a. |

| Lower Hutt: | |||||||||||||

| Epuni/Avalon | 4.8 | 4.9 | 5.1 | 5.6 | 5.1 | 5.5 | 5.8 | 5.2 | 5.1 | n.a. | n.a. | n.a. | n.a. |

| Taita/Naenae | 5.5 | 5.6 | 5.8 | 6.1 | 6.2 | 6.5 | 6.8 | 6.9 | 7.1 | n.a. | n.a. | n.a. | n.a. |

| Wainuiomata | 5.7 | 5.9 | 5.9 | 6.3 | 7.0 | 7.2 | 7.7 | 7.7 | 7.7 | n.a. | n.a. | n.a. | n.a. |

| Wellington: |

|

||||||||||||

| Johnsonville/Newlands | 5.0 | 5.0 | 4.9 | 4.8 | 4.8 | 5.2 | 5.5 | 5.4 | 5.6 | 5.8 | 5.6 | 5.5 |

6.2

|

| Vogeltown/Berhampore/Newtown | 4.5 | 4.5 | 4.2 | 4.1 | 4.6 | 4.9 | 5.4 | 5.2 | 5.5 | 5.1 | 5.5 | 5.2 |

5.6

|

|

|

|||||||||||||

| Tasman: |

|

||||||||||||

| Motueka | 5.0 | 4.4 | 4.0 | 4.0 | 4.7 | 5.3 | 5.2 | 5.4 | 5.3 | 5.3 | 5.5 | 5.6 |

5.5

|

| Richmond/Wakefield/Brightwater | 4.8 | 4.6 | 4.7 | 4.6 | 4.8 | 5.3 | 5.3 | 5.3 | 5.5 | 5.6 | 5.6 | 5.8 |

5.9

|

| Nelson - Stoke/Nayland/Tahunanui | 4.8 | 5.0 | 5.1 | 5.1 | 5.2 | 5.3 | 5.5 | 5.7 | 5.8 | 5.9 | 5.7 | 5.7 |

6.0

|

| Blenheim | 5.7 | 5.6 | 5.8 | 6.3 | 6.5 | 6.5 | 7.0 | 7.0 | 6.4 | 6.5 | 6.5 | 6.6 |

6.5

|

|

|

|||||||||||||

| Christchurch: |

|

||||||||||||

| Hornby/Islington/Hei Hei | 5.6 | 5.6 | 5.6 | 5.7 | 6.1 | 6.1 | 6.0 | 6.0 | 6.2 | 6.2 | 6.3 | 6.5 |

6.3

|

| Riccarton | 5.1 | 4.7 | 5.0 | 5.2 | 5.5 | 5.0 | 5.7 | 5.0 | 4.9 | 5.9 | 5.2 | 4.9 |

5.1

|

| Woolston/Opawa | 6.2 | 6.0 | 6.2 | 6.5 | 6.6 | 7.4 | 6.3 | 6.4 | 6.6 | 6.8 | 7.3 | 7.2 |

8.0

|

| Ashburton | 6.3 | 7.0 | 8.3 | 8.4 | 6.3 | 6.1 | 6.2 | 7.0 | 6.9 | 7.0 | 6.8 | 6.7 |

7.2

|

|

|

|||||||||||||

| Timaru | 6.0 | 5.7 | 6.0 | 5.9 | 6.1 | 6.4 | 6.5 | 6.4 | 6.2 | 6.6 | 6.8 | 6.7 |

6.3

|

|

|

|||||||||||||

| Queenstown/Frankton/Arrowtown | 4.4 | 4.6 | 4.3 | 4.1 | 4.5 | 4.3 | 4.6 | 5.2 | 5.0 | 4.8 | 4.9 | 4.7 |

5.3

|

|

|

|||||||||||||

| Dunedin: | |||||||||||||

| Kenmure/Mornington | 5.8 | 6.3 | 7.5 | 6.5 | 6.3 | 6.7 | 7.9 | 7.1 | 6.6 | n.a. | n.a. | n.a. | n.a. |

| Mosgiel | 5.4 | 5.4 | 5.5 | 5.7 | 5.7 | 5.7 | 6.4 | 6.4 | 6.1 | n.a. | n.a. | n.a. | n.a. |

| South Dunedin/St Kilda | 8.6 | 8.0 | 7.9 | 7.5 | 8.1 | 7.4 | 7.2 | 8.0 | 8.2 | n.a. | n.a. | n.a. | n.a. |

| Invercargill | 8.9 | 8.3 | 8.3 | 7.9 | 8.3 | 8.4 | 8.7 | 9.1 | 9.0 | 6.7 | 9.0 | 9.2 |

9.5

|

|

Source : REINZ / MBIE *Yield is a property's annual rent expressed as a percentage of its purchase price. The indicative yield figures in this table are gross, and are calculated from the REINZ's lower quartile selling price for three bedroom houses in each area during the previous 6 months, and the median rent for three bedroom houses calculated from new tenancy bonds received by the Ministry of Business Innovation and Employment for the same areas/period. This gives an indication of the gross rental yield that would have been achieved in each area if a three bedroom house was purchased at the lower quarter price and rented at the median rent for that area. |

|||||||||||||

You can receive all of our property articles automatically by subscribing to our free email Property Newsletter. This will deliver all of our property-related articles, including auction results and interest rate updates, directly to your in-box 3-5 times a week. We don't share your details with third parties and you can unsubscribe at any time. To subscribe just click on this link, scroll down to "Property email newsletter" and enter your email address.

Source: Latest stories from interest.co.nz | 19 Oct 2017 | 9:34 am

The Opening Bell: Where currencies start on Thursday, October 19, 2017

The NZDUSD opens at 0.7146 (mid-rate) this morning.

The NZDUSD opens at 0.7146 (mid-rate) this morning.

The NZD is down against the majority of its trading rivals with yesterday’s disappointing dairy trade auction weighing heavily on the currency. We expect the NZD to trade sideways ahead of Winston Peter’s announcement on which party he will side with to form a government.

Overnight a sharp fall in US housing starts and building permits saw the USD pull back from its intraday highs. The Commerce Department report showed housing starts plunged 4.7%in September to an annual rate of 1.127m. During the same period building permits plummeted 4.5% to an annual rate of 1.215m with August’s previously reported result also downwardly revised to 1.272m.

The UK unemployment rate remained at 4.3% in the three months to August, its lowest level since 1975 and in line with expectations. Average earnings increased by 2.2% during the same period slightly ahead of the expected 2.1 increase.

Global equity markets have turned positive - Dow +0.67%, S&P 500 +0.14%, FTSE +0.36%, DAX +0.37%, CAC +0.42%, Nikkei +0.13, Shanghai +0.29%.

Gold prices have edged lower, down 0.4% trading at $1,280 an ounce. WTI Crude Oil prices have are up 1.0% overnight currently trading at $52.04 a barrel.

Current indicative rates:

NZDUSD 0.7146 -0.3%

NZDEUR 0.6053 -0.6%

NZDGBP 0.5413 -0.4%

NZDJPY 80.64 0.2%

NZDAUD 0.9107 -0.4%

NZDCAD 0.8909 -0.9%

GBPNZD 1.8474 0.4%

To subscribe to our free daily Currency Rate Sheet and News email, enter your email address here.

Email:Dan Bell is the senior currency strategist at HiFX in Auckland. You can contact him here »

Source: Latest stories from interest.co.nz | 19 Oct 2017 | 8:39 am

NZD modestly weaker on dairy auction, Government announcement. Market yawns at China speech. ECB taper to be 'drawn out'. Global bond rates push higher

Another day, another push higher in global equity markets to fresh highs, with strong US earnings supporting the move. The NZD is on the soft side as we await the formation of a new government, while JPY is softer as global bond rates push higher.

Not a lot of news out there to drive markets. On the economic front, US housing starts and permits were weaker than expected, but the data were dragged down by Hurricanes Harvey and Irma. UK labour market data showed the unemployment rate steady at a 42-year low and with earnings growth continuing to lag inflation.

It’s hard to summarise China’s leader Xi Jinping 3 hour 20 minute opening address to the 5-yearly Communist Party Congress in a nice soundbite. The WSJ noted that it was a robust and lengthy defence of the Communist Party’s role as captain of the economy, and while it touched on openness and reforms, the speech was more focused on government-led initiatives. Bloomberg noted that the message was more focused on “quality” of growth rather than “quantity”, so there was no reiteration of the previous leader’s pledge to double the size of the economy, and there was more mention of the “environment”. Market reaction to the monologue was fairly muted.

USD indices are flat for the day. Within the mix, CAD is the best performer, following its rally from early yesterday morning on reports that NAFTA negotiations might extend into 2018 as key policy differences remain. USD/CAD is down 0.4% to 1.2470.

The NZD has been tracking modestly weaker over the past 24 hours and is just under the 0.7150 mark after reaching as low as 0.7120 last night. Two factors are likely in play. The soft GDT dairy auction triggered a couple of forecast reductions to Fonterra’s milk payout for the current season. BNZ reduced its projection from $6.75 to $6.30. The makings of soft dairy pricing continuing over coming months are there. The currency market is also nervous ahead of a possible announcement later today of the formation of a new government. Yesterday, NZ First issued a press release statement that it would be in a position this afternoon to make an announcement on the result of negotiations. Expect some short-term NZD volatility.

Also on the soft side, JPY has underperformed as global rates push higher. USD/JPY is up 0.6%, closing in on the 113 level, while NZD/JPY is up to 80.7. The US yield curve is steeper, with the 10-year rate up 4bps to 2.34% and the 2-year rate up 1bp to 1.56%. Germany and UK 10-year rates are up 3-4bps.

A number of factors are in play for the increase in rates. The FT ran a story stating the case for a reduction in ECB purchases from €60bn per month to €20bn from next year, but extending the purchases through to the end of next year. This “drawn out” programme, would deliver a steeper reduction in ECB demand for bonds, but also delay any potential rate hike well into 2019, in a bid to soften any impact on the euro. In the US, speculation continues around who the next Fed chair will be. Sources suggest that Trump’s choice will be unveiled before 3 November. New York Fed President Dudley said the central bank is on track to deliver on its forecast of three interest rate hikes in 2017. Finally, US tax reform negotiations are bubbling away in the background.

AUD, GBP and EUR have all showed little movement against the USD. The underperforming NZD sees all the crosses weaker. NZD/AUD has found some support at the 0.91 level.

The NZ rates market continues to trade quietly. There hasn’t been much activity in the lead-up to the NZ government formation announcement. Rates and spreads to the US and Australia remain below pre-election levels, indicating a lack of concern about the obvious extra fiscal stimulus we’ll see in the years ahead. NZ’s 10-year bond rate closed down 4bps yesterday to 2.90%, with the 60bp spread to the US 10-year rate at the time being at the narrower end of recent ranges. The 10-year swap rate fell by 2bps to 3.18%, while the 2-year swap rate was flat at 2.20%.

An announcement on government formation will keep the market on its toes today, with Australian employment and China activity data added to the mix.

Get our daily currency email by signing up here:

Email:Daily exchange rates

BNZ Markets research is available here.

Source: Latest stories from interest.co.nz | 19 Oct 2017 | 7:53 am

Fed Beige Book positive; Trump reveals Fed shortlist; US homebuilding sags; Rio Tinto charged with fraud; Canada factory output jumps; OECD warns on pensions; UST 10yr yield at 2.34%; oil and gold unchanged; NZ$1 = 71.5 US¢, TWI-5 = 74.2

Here's my summary of the key events overnight that affect New Zealand with news Rio Tinto is to face a major fraud charge centered around some dodgy market disclosure.

But first in the US, the Federal Reserve reported that economic activity "grew at a measured pace" across the country in September and October, despite sector-wide disruptions caused by recent hurricanes in the Southern and Eastern states. This Beige Book release was more positive than many had expected.

In Washington, the President is considering his nomination for the Fed chairman position and a decision is expected within two weeks. The candidates are The finalists are now Janet Yellen, current Fed governor Jerome Powell; former Fed governor Kevin Warsh; White House official and ex-Goldman Sachs boss Gary Cohn; and Stanford University economist John Taylor. None are considered a 'favourite' at this stage.

American homebuilding fell to near a one-year low in September as those major storms in the South disrupted the construction of single-family homes, suggesting housing probably remained a drag on US economic growth in the third quarter. Still, that data was actually +6.1% higher than for the same month a year ago. Building permits, while running at a higher level than housing starts, are however actually now -4.3% lower than the year-ago month.

In New York, the SEC charged Melbourne-based miner Rio Tinto and two of its former top executives with fraud, saying it deliberately withheld disclosure and left inflated the value of coal assets in Mozambique when they knew they were distressed, concealing this while tapping the market for billions of dollars. ASIC is now also looking at the alleged flawed disclosure. Rio Tinto claims innocence.

Canadian factory sales jumped in August with a sharp gain. Markets had expected a third straight fall. The positive reversal was based on higher demand in their car industry, and higher oil prices.

News out of China this week is all caught up in shameless propaganda. But we should note that the Chinese yield curve suddenly turned negative overnight - well at least the 5-10 curve did.

The OECD today released a report on what younger people can expect from their retirement programs and the tone was grim. They say younger generations will face greater risks of inequality in old age than current retirees and for generations born since the 1960s, their experience of old age will change dramatically. Moreover, with family sizes falling, higher inequality over working lives and reforms that have cut pension incomes, some groups will face a high risk of poverty. But the outlook for New Zealand presented in the Report is far more positive. Where New Zealand data is referenced, we seem to exhibit few of the issues the OECD is banging on about.

In New York, the UST 10yr yield is rising again and is now at 2.34%.

The price of crude oil is marginally firmer today and now just over US$52 / barrel, while the Brent benchmark is just over US$58.

The price of gold is marginally softer and now at US$1,283 oz.

And the Kiwi dollar is also marginally softer at 71.5 US¢. On the cross rates we are at 91.1 AU¢, and at 60.6 euro cents. Our TWI-5 index is now at 74.2.

If you want to catch up with all the changes yesterday we have an update here.

The easiest place to stay up with event risk today is by following our Economic Calendar here ».

Daily exchange rates

Source: Latest stories from interest.co.nz | 19 Oct 2017 | 6:11 am

Winston Peters' NZ First set to enlighten New Zealanders on the make-up of the new government on Thursday afternoon

In a very brief statement issued on Wednesday evening, Winston Peters' NZ First says we can expect to find out who the Government will be on Thursday afternoon.

Here's the NZ First statement.

New Zealand First will be in a position tomorrow afternoon to make an announcement on the result of negotiations following the 2017 General Election.

New Zealand First Leader Rt Hon Winston Peters said he had spoken to the leaders of the National Party and the Labour Party today and, amongst other matters, advised them of that.

New Zealand First's caucus spent Wednesday talking in Bowen House, after meeting with their board over Monday and Tuesday.

Just before 5pm Wednesday, MP Fletcher Tabuteau left the building, telling Newshub that talks were now “at a stage now where the caucus is no longer needed”.

Peters did not front to media after sending out the statement. MPs Shane Jones and Ron Mark declined to comment as they passed media in Bowen House Wednesday evening.

National Party leader Bill English later sent out a statement saying he would update his MPs on the coalition talks Thursday morning:

“National is holding a caucus meeting tomorrow at 11am in Wellington to provide MPs with an update on coalition talks. A separate teleconference will then take place with the National Party board. We stress that we have had no indication of what decision New Zealand First will make. We have no further comment at this stage.”

Meanwhile, a Labour party spokesman said Labour's leadership team would hold a teleconference with the party's caucus at 11am to provide them with an update, although a NZF decision isn't expected to be known by then.

The Green Party was reported to not be holding its delegates' conference call on Wednesday night - Thursday will also be the day for them. See more on that here.

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 5:31 pm

The Weekly Dairy Report: Production forecasts fall on a very wet spring but so do prices at auction

Another dry up week in the South, but with some days of good sunshine and warmth, pasture growth rates have lifted close to achieving a balance day mark.

Canterbury has soils now much wetter than average, and this has caused some delays in crop establishment, pasture renewal and preparing ground for next year’s winter crops.

The North Island continues to struggle with wet conditions, and this week Fonterra adjusted downwards their milk production forecast from 3% ahead of last year, to just 1%.

With mating now getting close in the south, dairy staff are monitoring heats, mineral status, and body condition scores, to ensure cows are in their best possible order when the day of joining arrives.

In the north where mating has started, intervention procedures are in place to try and stimulate ovulation, with some cows lighter than normal, and pasture composition still too wet to maximise improvements in condition scores.

Rabobank believes dairy prices may have peaked, and global production has lifted in response to these levels, but they are also confident strong Chinese demand will sustain good returns for a while yet.

Latest Oceania prices confirmed this theory, with butter prices falling US$375/tonne, whole milk powders by a $100/tonne, while the other two main commodities remained steady.

The global dairy auction overnight also showed more weakness with the index falling again by 1%, lead by skim milk powders with a 5.6% drop, but also falls from whole milk powder, which is only $14 from the $3000/tonne mark.

This was on the back of a falling milk derivative market, increasing peak volumes offered by Fonterra, and a weaker currency that failed to stimulate prices

Bank economists are now also getting nervous, with ANZ and BNZ both adjusting downwards to the low $6 mark, but the ASB still predicts commodity prices adjusting back up later, and allowing the $6.75 forecast to remain.

The disease outbreak in South Canterbury/North Otago reached it’s next stage, with officials deciding to cull all 4000 cows from the infected farms.

This will be devastating news to the owners, but the correct decision to try and isolate this disease at its source, and reports suggest neighbours and those dairy farms close by, are supportive of MPI’s response.

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 3:01 pm

A review of things you need to know before you go home Wednesday; dairy prices slip, payout under pressure, strong jobs growth, NZSF's outstanding returns, life expectancy, swaps slip, NZD holds

Here are the key things you need to know before you leave work today.

MORTGAGE RATE CHANGES

No rate changes today.

DEPOSIT RATE CHANGES

None here either today, so far at least.

GETTING NERVOUS

A second consecutive drop in dairy prices overnight, although not large, is getting analysts concerned about the 2017/18 payout level. The expected firming is not arriving. It has prompted economists to drop their forecast milk price from $6.75 to as low as $6.30.

KEY APPOINTMENT

ANZ NZ, the country's biggest bank, is to get ex-PM John Key as its local board chairman from January 2018.

WHERE THE JOBS ARE

The number of online job advertisements remained steady with an increase of +9.6% in September 2017 from the same month a year ago, according to the latest Ministry of Business, Innovation and Employment (MBIE) Jobs Online report. They report the largest occupation increases were for labourers (up +27% in a year) and machinery drivers (up +28% in a year). In contrast, managers only saw a +3.8% rise, and professionals saw a +5.4% rise in demand.

OUTSTANDING PERFORMANCE

The NZ Super Fund has reported at +1.66% return in September 2017 from August, and a +19.2% return over the year to September. This is an before-tax, after-fees return and far above its benchmark, and that is up from the +12.5% gain it has shown in the past three years. Since inception 14 years ago (2003), the Crown has contributed $14.9 bln and from that the fund managers have earned another $27.7 bln in gains, and out of that has paid the Crown back $6.1 bln in taxes. By any measure this is outstanding - and yet the Auditor General State Services Commissioner thought the NZSF boss was not worth what he is being paid. Fortunately the NZSF board ignored the Auditor General's advice.

LATE GAINERS

Australia reported its updated life expectancy (at birth) data today. That shows Aussie females can expect to live to 84.6 years and males to 80.4 years. The equivalent NZ expectation is 83.4 yrs for females, and 79.9 yrs for males. At aged 65, an Australian female can expect to live to 87.3 years while a male can expect to live to 84.6 yrs. (NZ equivalent numbers are 88.6 yrs and 86.2 yrs. So, it seems at retirement you can expect to live at least a year longer in New Zealand, even if at birth we start behind the Aussies.)

IGNORING THE LAW

And staying in Australia, Melbourne's James Packer-owned Crown Casino altered poker machines to get around regulations and lower returns to players, and large transactions were hidden from money laundering authorities, former staff allege in sensational and damning evidence tabled in the Australian Federal Parliament.

WHOLESALE RATES REVERSE

The rises we reported here yesterday at 4pm subsequently evaporated in late-day trade as offshore influences grew. And today, we have seen the long end decline further by up to -3 bps. The 90 day bank bill rate is unchanged at 1.93%.

NZ DOLLAR UNCHANGED

The NZ dollar is holding at 71.6 USc. On the cross rates we up a little at 91.3 AUc and 60.9 euro cents. The TWI-5 is still at 74.4. The bitcoin price has dipped -3% today to US$5,484.

You can now see an animation of this chart. Click on it, or click here.

Daily exchange rates

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 2:31 pm

Insurance industry raises concerns over the RBNZ being the entity to conduct a major review of the legislation it uses to regulate the sector

The insurance industry is supporting the Reserve Bank’s (RBNZ) move to improve the way it regulates the sector.

However questions are being raised around whether the Bank should be the entity conducting the review of the legislation that gives it its mandate.

Releasing a feedback statement on the 42 submissions it received on an issues paper sent out in late March, the RBNZ says stakeholders generally believe the Insurance (Prudential Supervision) Act 2010 (IPSA) has improved the “soundness” of the insurance sector “without unduly restricting competition or innovation”, or introducing “inappropriate compliance costs”.

They acknowledge there’s room for improvement, but don’t believe any fundamental changes need to be made to the legislation as a whole.

Nonetheless, some submitters feel a review of the legislation should be conducted by an independent agency. The RBNZ “does not see a strong case” for this.

It says: “The current Review is being under taken by the Reserve Bank under terms of reference agreed by Cabinet. The Review will be completed transparently and with wide consultation.

“Any legislative changes recommended from the Review will happen only with due Parliamentary process i.e. any legislative change would ultimately require the support of and be the responsibility of the relevant Minister (currently the Minister of Finance is responsible for IPSA) and Parliament.”

The RBNZ’s Head of Prudential Supervision, Toby Fiennes, made his stance on regulation quite clear when he in May told interest.co.nz he wasn’t keen for the RBNZ to be as “intrusive” as its counter parts around the world.

He said New Zealand runs a “different model” that’s cheaper and more efficient.

More engagement necessary?

Yet a number of submitters on the issues paper want the RBNZ to engage more with its stakeholders and provide them with more clarify and guidance.

In fact, 12 of the 36 insurers the RBNZ assessed between February and June in its Insurer Disclosures Thematic Review had compliance issues when it came to disclosing solvency in their financial statements. Twenty-two didn’t disclose their financial strength ratings properly.

The RBNZ notes the International Monetary Fund (IMF), in its Financial Sector Assessment Program (FSAP) made similar recommendations to the submitters about the RBNZ’s approach towards regulating insurers.

“The Reserve Bank is reflecting on this issue, as a part of our response to the IMF FSAP recommendations, rather than in the IPSA review,” the RBNZ says.

“The focus for the IPSA Review is that the legislation continues to allow for a risk-based approach to regulation and supervision, and permits a range of supervisory approaches to be taken by the Reserve Bank within the limits of its resources.”

Overseas insurers and disclosure

Back to the issues paper, the RBNZ says the following areas received the most support from submitters:

- the scope of the legislation: which business lines and entities are subject to the requirements of IPSA and Reserve Bank prudential supervision, including ensuring the legislation caters appropriately for innovation arising from the increased use of technology within existing insurance business models and the potential for disruptive new entrants;

- overseas insurers: the treatment of overseas branch operations, which should balance the value of overseas insurer participation in the New Zealand market, including reinsurance firms, against potential risks to New Zealand policyholders’ and broader economic interests;

- disclosure: to ensure that disclosure requirements and data collections are reasonable, and able to be efficiently complied with, including facilitating the use of technology to aid compliance; and

- enforcement tools: balancing the enforcement tools available to the Reserve Bank with the Reserve Bank’s enforcement and supervisory approach.

The RBNZ will consider both submitters’ feedback, as well as the IMF’s recommendations, in Phase 2 of its review. Phase 2 will extend into 2019.

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 12:12 pm

With no current Government and no permanent Reserve Bank Governor, there's potential for important decisions regarding housing to be left late

By David Hargreaves

Timing is everything.

And some of the timing around decisions ultimately affecting the housing market is not looking great at the moment.

It is anybody's guess when we will get a government sworn in and up and running.

What's rather more predictable is that Christmas and the end of the year are both approaching with great speed.

Even if the shape of the next government is settled this week, it's very questionable how much can now be achieved before Parliament goes into recess in December.

Given the delays that have occurred since the September 23 election, would our MPs consider staying on in Parliament for longer than usual this year to get the new government up and running?

Well, you can argue that maybe they should. But I wouldn't bet on it.

Priorities

The interesting thing then will be priorities and what things logistically the new government will attempt to tick off - and what is physically possible before the end of the year.

The portents in all this are maybe not good for the housing market.

At the moment obviously uncertainty rules. Anecdotally the banks' lending policies are getting tighter and tighter - possibly in some part due to the uncertainty.

The latest iteration of the Reserve Bank's LVR restrictions - the 40% deposit rule for investors - is still seemingly having an impact too.

We are just at the point when the question is worth seriously asking about whether the RBNZ should now be considering backing off with the LVRs.

LVRs a blunt instrument

I would imagine the RBNZ itself is still pretty happy with how things are at the moment. But LVRs are a somewhat blunt instrument - and there would be a risk in the restrictions going on for too long in their current form.

However, the RBNZ's probably reluctant to look at lifting them without further back-up insurance. Of course, it is still keen on debt-to-income ratios, but the National Government effectively pushed that down the road and beyond the election through getting the RBNZ to consult on it first before any agreement was considered for including it as one of the options in the 'macro-prudential toolkit'.

Separately both Prime Minister Bill English and Labour leader Jacinda Ardern later poured cold water on the idea of DTIs. And indeed it's possible depending on the hue of the future government that there may be a push-back against the RBNZ's use of macro-prudential tools.

Also, there's the possibility the RBNZ's Policy Targets Agreement with the Government may be reworked - potentially removing inflation as the sole target of monetary policy and adopting a broader focus.

And, whoever forms the Government, it's likely that some move towards a formalised committee process for interest rate decisions will be established. Such a process has informally been in place at the RBNZ in recent times - but officially the decision is still that of the Governor and the Governor alone.

A new Governor would be good

All these kinds of issues will be occupying the mind and thoughts of the new RBNZ Governor. Oh, and that's right, we haven't got one of those yet.

It will be up to the new Government to sign off on a new Governor to replace Graeme Wheeler, who left in September.

The previous Deputy Governor Grant Spencer stepped up to the plate as Acting Governor for a six month term that will expire in late March.

Under Spencer then a steady-as-she-goes course can be expected. But it's difficult to see much inclination on his part to undertake substantial new initiatives - certainly not till there's a new Government in place and some indication when a new RBNZ Governor will be appointed.

What then if the Government doesn't get around to appointing a new Governor before the end of the year?

Well, that could be pretty interesting to say the least.

If a Government was up and running by the start of November and able to swiftly appoint a new Governor, then it's to be imagined said Governor may well still be able to take up their appointment by the time Spencer is leaving in late March. It does of course depend whether the appointment is internal or external.

A bit fraught

But leave a decision till after Christmas and things are likely to get a bit fraught. It's to be imagined that a lot of the decisions that will need to be made by a new Governor simply won't be able to be addressed.

Within all that then is what happens to the housing market.

With the uncertainty still hovering around who will govern the country, it seems we can now definitely kiss goodbye to any prospect of a meaningful rally in the market before Christmas.

After the 2014 election, when the status quo was returned to Government, the housing market exploded in the run-up to Christmas.

That would not have happened this year in any case, given the LVR restrictions on investors and the conservative line being taken by banks to new lending.

A quiet housing market

But the probability, with the way things have panned out, is that the market's now going to be real quiet up to Christmas and therefore, real quiet till probably March.

I think there is a risk that with the RBNZ not having permanent new leadership in place, and not even knowing properly what rules it will be having to abide by under a new Government, that the currently very tight regime on the housing market will be left in place for too long.

Now, with the market as it is at the moment, we are some way off (I would have thought) any suggestion of investors feeling pressured to sell properties. But if interest rates do, partly based on uncertainty, start to push up again in the new year, will this be a trigger for more investors to look to offload properties.

The risk then would be that the LVR policy - designed to stop sharp corrections in the market that might put banks under pressure - could actually lead to such a scenario.

Food for thought

I don't want to be alarmist. But I just hope people are thinking about these things.

The housing market looks fairly balanced at the moment and could probably tip either way.

It needs vigilance and responsiveness from the powers-that-be. With no Government and no permanent RBNZ Governor this is a far from ideal situation.

Whenever a new Government is formed, it is to be hoped that things like the new RBNZ Governor and the Policy Targets Agreement are given urgent priority.

Otherwise there is some potential for matters in the housing market to get away from us.

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 11:16 am

The University of Auckland's David Mayes argues reducing the impact of financial downturns should be a higher priority than it is

By David Mayes*

There is a lot of talk in this country about minimising financial booms by using the debt-to-income ratio (DTI) to measure loan serviceability. It is a very crude measure, says David Mayes, Professor of Banking and Finance at the University of Auckland Business School. And in any case, that is not where our priorities should lie.

There is a lot of talk in this country about minimising financial booms by using the debt-to-income ratio (DTI) to measure loan serviceability. It is a very crude measure, says David Mayes, Professor of Banking and Finance at the University of Auckland Business School. And in any case, that is not where our priorities should lie.

Mayes says that New Zealand has fewer ways to limit the costs of financial downturns than other advanced countries. Righting that imbalance through deposit insurance, deposit and resolution funds, and measures to better manage non-performing loans should come before further attempts to control financial booms.

"There has been much less emphasis in this country on limiting the impact of a falling housing market and a general economic downturn than elsewhere in the developed world."

He says the Reserve Bank's long-standing Open Bank Resolution (OBR) policy – which allows a bank to remain open after being placed under statutory management – is designed to limit risk-taking, and to encourage private sector solutions for troubled banks.

"But OBR is expensive, because New Zealand does not have deposit insurance, so depositors are likely to feel the impact, and that in turn is likely to have a larger effect on consumers than elsewhere."

Nor are deposit insurance or resolution funds available. The accumulation of such funds when the economy is doing well tends to slow lending growth, and when used, they dampen the effect of a downturn on consumption and economic activity.

Mayes says we also lack other mechanisms that are common elsewhere for reducing the harm of financial downturns, including:

• a system for ameliorating problems with mortgage defaults

• insurance through the public sector

• the facility for sale by banks to a corporation that could restructure mortgages

"The lack of such a safety net is largely due to fears of 'moral hazard', but this does not alter the fact that in a downturn, the costs are higher under the existing framework," says Mayes.

A further approach to minimising the costs of a down phase, which is yet to be addressed in New Zealand, but which is being considered elsewhere, is the handling of non-performing loans, he says.

"The typical cycle with such loans is, first, to fail to recognise their actual or potential size as problems start to emerge, and second, to make insufficient provision for non-performance."

Then, when problems do become apparent, the bank faces twin difficulties, he says. Any actual losses cause capital ratios to fall and more capital is needed at the very time when it is hardest to raise in the market; and, the pressure on capital will result in a much harsher credit crunch, with the bank unable to resolve problem loans or make new, profitable ones.

"In looking at what macro-prudential tools ought to be used, we should therefore avoid focusing on those that restrict lending. This is particularly the case for DTIs, which constrain serviceable loans in order to have sufficient impact on loans that might become non-serviceable in the event of a downturn.

"The focus needs to be on the ability to handle problems in a downturn, at a low cost to society."

*David Mayes is a Professor of Accounting and Finance at the University of Auckland Business School.

This article was first published in UABS Insights, and is reproduced with the permission of the University of Auckland Business School.

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 11:15 am

ANZ NZ, the country's biggest bank, to have ex-PM John Key as its chairman from January 2018

Former Prime Minister John Key is to replace outgoing ANZ Bank New Zealand chairman John Judge.

ANZ confirmed the move on Wednesday, which has been rumoured in the banking sector for some time.

Judge is set to retire in January. He has been on the ANZ NZ board since December 2008, and its chairman since June 2012. Key joins the board today, October 18, and will succeed Judge as chairman in January.

David Gonski, chairman of Australian parent ANZ Group, said Judge’s tenure included significant change at ANZ NZ.

“The National Bank and ANZ brands and technology systems were successfully merged in 2012 and the business has grown significantly. ANZ New Zealand now has the biggest market share for home loans, deposits, credit cards and KiwiSaver, and is leading the way with digital services," Gonski said.

Gonski said Key would add "great value."

“Sir John Key’s strong international career in banking and his understanding of and contacts across the Asia-Pacific – where many Australian and New Zealand companies are increasingly trading - will add great value to the governance of ANZ,” said Gonski.

Key, a former head of global foreign exchange with Merrill Lynch, was Prime Minister from 2008 until his surprise resignation late last year. Since stepping down as PM he has also joined the Air New Zealand board as an independent director.

During his time as PM Key was popular among the banking fraternity. Former Westpac NZ CEO George Frazis said of Key in 2011: "The Prime Minister has a business background, an ex-banker, and this is resulting in quite decisive, responsive decision making based on really sound, fundamental economic objectives."

"For banking what that sees is a government much more focused [than Australia's] on growth and credit availability, which in turn is contributing to the improved economic outlook," Frazis added.

Key follows in the footsteps of another former National Party leader, Don Brash, who was on the ANZ NZ board, when it was known as ANZ National Bank, from 2007 to 2011. Brash is now chairman of the Chinese government controlled bank, ICBC NZ.

ANZ NZ’s other current independent directors are Tony Carter, Mark Verbiest and Joan Withers. Executive directors on the board are ANZ NZ CEO and group executive David Hisco, ANZ Group chief risk officer and group executive Nigel Williams, and ANZ Group CEO Shayne Elliott.

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 10:26 am

NZ First caucus meets over finer points after 2-day meeting with board which canvassed every policy in each of National's and Labour's packages - 'more than just 5 or 10'; Shane Jones says it's ring-sizing day - for his own nuptials

By Alex Tarrant

New Zealand First’s caucus was meeting Wednesday morning to discuss whatever came out of Winston Peters’ meetings with Bill English and Jacinda Ardern last night, and to possibly begin discussions on government structure and desired Ministerial positions.

The party’s MPs filed into Bowen House at different times and through different entrances through the early morning – some stopping to speak to media, although not much was gleaned from them outside of what leader Winston Peters said Tuesday evening.

The caucus has just sat through a joint two-day meeting with the party’s board Monday and Tuesday. Leader Winston Peters said Tuesday evening that the party had reached 95%-98% consensus on what the two policy platforms on the table from National and Labour “both mean”.

Interest.co.nz sought clarification on whether Peters had meant there was consensus on what the party would go back to National and Labour with in terms of any tweaks they would seek to each policy platform, or whether the comment meant there was consensus on what each package – as reviewed over the past two days – would deliver for NZ First policy-wise?

“The latter,” was the response.

I put to another NZ Firster that taking two days to understand the two policy packages that came out of last week’s negotiations seemed quite a long time for just that, while having nothing else come out of the meeting.

The response was that the board and caucus had covered off and clarified what Labour’s and National’s positions were on each policy in each package, and where New Zealand First stood on each one. This required a lot of work, it was said, as a huge amount of policy was reviewed – not just five or ten items.

We're getting close

Fletcher Tabuteau was the first New Zealand First MP to enter the building where the media pack was waiting Wednesday morning. He is the party’s spokesman on commerce, tourism, trade, energy and revenue, and was consistently part of last week’s negotiating teams with Labour and National.

He said he had “no idea” how things would go through the morning. “I’ve been in negotiations and then caucus and board, and we go from here." Asked whether we might get an announcement today, he looked skyward for a few seconds before replying, “I’m not sure. I couldn’t say that with any…well we’re getting close, right?”

New MP Mark Patterson was next. “We’re at the business-end. There’s no doubt about that, so we’ll find out,” he said. “It’s probably beyond us, a lot of this stuff now – there’ll be other parties that make, that have to make that call.”

“Winston was pretty candid with you last night. We’re about 98% of the way there, with the stuff, with the policy stuff. So, that’s just about done and it’ll be up to the leadership now.”

It was then Shane Jones’ turn. He wouldn’t comment on whether he expected a decision today. “Our Rangatira Winston, he’ll be handling all that.” Jones said there would be re-engagement this morning. “Come on folks, it’s still a good day, and people are getting paid,” he said before telling the media pack that today was the day he was getting his wedding ring fitted for his upcoming nuptials in Rarotonga. “It’s ring-sizing day.”

“We shouldn’t overlook the hard work that’s already happened. And of the decisions that you’re looking for, Winston will, at the duly appointed time, be making an announcement,” he said. “I’m not sure if I’m going to go for - my ring – whether it will be sapphire or ruby, but I’m getting married and I’ve got ring-sizing today.”

'I don't want to lower the 5% threshold'

Meanwhile, Winston Peters issued the following release regarding a comment in the Dominion Post's editorial Wednesday morning that he'd like the 5% threshold the be reduced. He's not a fan of the idea, apparently:

LET’S STOP THE LIES

Fairfax claimed before 446,287 votes were even counted in the 2017 General Election that I was holding the country to ransom.

Second, that I had tried to get a deal on an electorate seat.

Today’s editorial is slovenly and deceitful in the extreme and it begins by saying I want to reduce the 5 per cent parliamentary threshold for political parties. What is so bad about that lie is that it is so blatant.

On the review of the electoral system, to which political parties made submissions, New Zealand First submitted that the threshold should remain at 5 per cent. That view was made public by us and was widely broadcast at the time.

That being the case, why have you attempted to deceive readers for the umpteenth time where New Zealand First is concerned?

In 24 years New Zealand First has never tried to do a deal with another political party prior to the election.

Would you please tell your readers where you get your evidence, or is making it up as you go along your professional forte?

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 10:09 am

Further weakness in the latest global dairy auction has prompted economists to drop their forecast milk price from $6.75 to as low as $6.30

By David Hargreaves

Another weak performance in the latest GlobalDairyTrade auction has prompted some economists to cut their forecast milk prices for the current season.

Economists at ANZ and BNZ were previously in line with the official Fonterra forecast, which is for a price of $6.75 per kilogramme of milk solids.

But not now.

ANZ's now forecasting between $6.25 and $6.50, while BNZ economists are picking $6.30. However, the long-time economist bulls at the ASB are retaining their pick of $6.75 and believe that global dairy prices will rise again before the end of the year. Westpac economists though, who are currently forecasting a $6.50 milk price, are now seeing some downside risk to that.

All this follows the latest dairy auction, which saw overall prices slip a further 1% and the key Whole Milk Powder price fall 0.5% to now be just above the US$3,000 per metric tonne mark.

Overall prices as measured by the GDT Index are down 4.6% since May, while WMP prices are down 9% in the same period.

BNZ senior economist Doug Steel said the general level of dairy prices at this auction combined with an NZD/USD hanging around in the low 70s makes forecasts for Fonterra’s milk price of $6.75 for the 2017/18 season "more tenuous".

"If current market conditions were to persist for the remainder of the season, our calculations suggest the milk price would be around $6.40. Even that may prove a bit on the high side given the potential downward price pressure stemming from the EU and the fact that dairy prices still look a bit stretched relative to international oil and grain prices.

"US milk production continues to rise. Strong milk fat prices (albeit with signs they will soften ahead) have not been enough to offset the decline in powder prices. All this sees us tab down our milk price forecast to $6.30 from the $6.75 we had nudged it up to a couple of months ago.

"Something a bit lower is possible on the EU news, while something higher is possible, if NZ milk production continues to lag last year, and Chinese demand was to prove strong over coming months. We think $6.30 currently sits more comfortably in the middle of a wide range of possible outcomes. An outcome of $6.30 would still see this season’s milk price comfortably above the previous season’s final milk price of $6.12."

ANZ rural economist Con Williams noted that longer contract delivery periods for WMP into next year were showing prices below US$3,000 per metric tonne, with the price 'curve' showing short term prices higher and longer term prices lower.

"The curve for WMP and SMP/milkfat both remain in backwardation suggesting either reasonable near-term demand for the Chinese free-trade window or the market feeling future supply will be more plentiful – we suspect it is a bit of both," he said.

However, Williams felt that even "near-term" delivery prices for the key products "are no longer high enough to justify a milk price forecast of $6.75/kg MS".

"They [the prices] are indicating something closer to the mid-$6/kg MS range. However, prices for key products to be delivered in the New Year are signalling something even lower and broke below the key US$3,000/t level overnight (WMP and SMP/milkfat combined).

'This warrants some caution'

"Combined with higher than expected milk flow from Europe in the New Year and possible unfavourable changes to the European intervention scheme, we believe this warrants some caution.

"Hence we downgrade our milk price forecast to $6.25-$6.50/kg MS for 2017/18."

ASB senior rural economist Nathan Penny said that "D-day" had arrived for NZ dairy production.

"Wet weather has now stalled spring production. And weak production at this time of the season is likely to impact the season as a whole.

"Subsequently, we have revised down our nationwide (i.e. for all processors) milk production growth forecast for the season to 3%, from 4% previously. This is a similar revision (albeit a tad smaller) to Fonterra’s forecast revision on Monday; Fonterra revised its growth forecast for the season on its collections down to 1%, from 3% previously.

"With this in mind, the auction result came as a surprise. After all, NZ production is the dominant driver of dairy prices for the products that matter to NZ. There are some factors in play which may have contributed to the weak result. In our view, however, these factors are all secondary to the material change in NZ production.

"Accordingly, we stick with our 2017/18 milk price forecast of $6.75/kg. Indeed, we expect weak NZ production to translate into higher auction prices by the end of the year."

Risks to production

Westpac economist Shyamal Maharaj said Westpac saw that the current risks to production will limit the total volumes milk collections for the 2017/18 season.

"However, we maintain our view that production volumes have room to pick up above the expected collections from Fonterra’s update despite the poor weather.

"On a global scale, we expect supply to certainly point to the upside of the previous season’s volumes. Of the factors driving demand, we expect that the outcome of the National Congress will provide colour around the size of influence an economic reforms may have on Chinese demand for our dairy products going into 2018.

"On balance, we retain our forecast farmgate milk price of $6.50/KgMs, though the risks are mounting to the down side. Our forecast is already lower than Fonterra’s $6.75/KgMs, where other market forecasters have been to date."

See here for the full dairy payout history.

Dairy prices

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 8:25 am

The Opening Bell: Where currencies start on Wednesday, October 18, 2017

The NZDUSD opens at 0.7169 (mid-rate) this morning.

The NZDUSD opens at 0.7169 (mid-rate) this morning.

The NZD is trading slightly higher against the majority of its rivals after yesterday’s inflation data came is ahead of expectations. The NZDUSD traded to a high of 0.7200 before a disappointing dairy auction led to a NZD sell-off.

Yesterday’s consumer price index (CPI) climbed 1.9% y/y with the September quarter increasing by 0.5%. Both results were higher than forecasts with economists predicting an increase of 1.8% and 0.4% respectively.

A tapering off of demand resulted in another negative result at this morning’s dairy auction. The new season auction results are now evenly balanced at 5 positive and 5 negative outcomes. The GDT price index fell 1% from the previous auction a fortnight ago to US$3,204 a tonne, volume also fell with 35,669 tonnes of product selling under the hammer, down from 37,990 tonnes at the previous auction.

Better-than-expected economic data releases out of the US has helped support the USD. Industrial production for the month of September increased by 0.3% (exp 0.2%) after falling by 0.7% in August, while both import and export prices increased more than forecast during the same month. US import prices rose 0.7% following a 0.6% increase in August, while export prices climbed by 0.8% in September following an upwardly revised 0.7% increase in august.

UK inflation for September increased to 3%, up from 2.9% in August and in line with expectations, but the GBP failed to take advantage of the data after new deputy Bank of England governor Sir Dave Ramsden said he was not part of the majority of policymakers who favoured a rate hike.

Global equity markets remain mixed - Dow +0.07%, S&P 500 -0.06%, FTSE -0.14%, DAX -0.07%, CAC -0.03%, Nikkei +0.38, Shanghai -0.19%.

Gold prices are down 1.2% trading at $1,285 an ounce. WTI Crude Oil prices have edged lower, down 0.7% overnight currently sitting at $51.55 a barrel.

Current indicative rates:

NZDUSD 0.7169 0.0%

NZDEUR 0.6089 0.2%

NZDGBP 0.5434 0.4%

NZDJPY 80.44 0.1%

NZDAUD 0.9141 0.1%

NZDCAD 0.8991 0.2%

GBPNZD 1.8394 -0.4%

To subscribe to our free daily Currency Rate Sheet and News email, enter your email address here.

Email:Dan Bell is the senior currency strategist at HiFX in Auckland. You can contact him here »

Daily exchange rates

Source: Latest stories from interest.co.nz | 18 Oct 2017 | 8:07 am